Understanding the role of a Davenport County Property Appraiser is essential for homeowners, investors, and anyone involved in the real estate market. Property appraisal is a critical process that determines the value of your property, influencing tax assessments, market sales, and overall property management. This guide will provide an in-depth look at the Davenport County Property Appraiser, including their responsibilities, processes, and how they impact the local real estate landscape.

Property appraisal plays a pivotal role in shaping the financial and legal aspects of real estate. Whether you're buying, selling, or maintaining a property, the accuracy and fairness of property valuation are crucial. In Davenport County, the property appraiser ensures that all properties are assessed fairly and consistently, contributing to a stable and transparent real estate market.

This article aims to shed light on the workings of the Davenport County Property Appraiser, offering insights into their processes, tools, and the importance of their services. By the end of this guide, you'll have a comprehensive understanding of how property appraisal impacts your financial decisions and how you can navigate the system effectively.

Read also:Hdhub4u New Movie Releases 2025 Your Ultimate Guide To Latest Blockbusters

Table of Contents

- Introduction to Davenport County Property Appraiser

- Role and Responsibilities of the Property Appraiser

- The Property Appraisal Process

- Understanding Property Valuation Methods

- Impact of Property Appraisal on Taxes

- Resolving Property Appraisal Disputes

- Tools and Resources for Property Appraisal

- Property Appraisal and Market Trends

- Legal Aspects of Property Appraisal

- Conclusion and Call to Action

Introduction to Davenport County Property Appraiser

Overview of the Appraiser's Office

The Davenport County Property Appraiser serves as a vital link between property owners and the local government. Their primary responsibility is to assess the value of all real estate properties within the county, ensuring that tax assessments are fair and equitable. The office operates under strict guidelines to maintain transparency and accuracy in property valuation.

The Davenport County Property Appraiser's team consists of certified appraisers, data analysts, and support staff who work collaboratively to provide reliable and up-to-date property assessments. This ensures that property owners receive accurate information about their property's value, which directly affects their tax liabilities.

Importance of Property Appraisal

Property appraisal is more than just a number; it plays a significant role in the real estate market. It helps determine the market value of properties, influences property taxes, and provides a benchmark for buyers and sellers. Accurate property appraisal ensures that the real estate market remains stable and that property owners are treated fairly in terms of taxation and property rights.

For homeowners, understanding the appraisal process can help them manage their finances better. It also allows them to contest inaccurate assessments and protect their property rights. In Davenport County, the property appraiser's office provides resources and support to help property owners navigate this complex process.

Role and Responsibilities of the Property Appraiser

Key Responsibilities

The Davenport County Property Appraiser is responsible for several critical tasks, including:

- Assessing the market value of all real estate properties within the county.

- Ensuring compliance with state and federal regulations regarding property valuation.

- Providing property owners with accurate and transparent information about their property's value.

- Handling disputes and appeals related to property appraisals.

- Maintaining up-to-date records of all property assessments and transactions.

These responsibilities ensure that property owners receive fair and accurate assessments, which are crucial for maintaining a stable and equitable real estate market.

Read also:Movie Rulzcom 2024 Telugu Your Ultimate Guide To Telugu Movies

Certifications and Expertise

Property appraisers in Davenport County are required to hold specific certifications and undergo regular training to maintain their expertise. These certifications ensure that appraisers are well-versed in the latest appraisal methods and technologies. The Davenport County Property Appraiser's office invests in continuous education and professional development to ensure that their team remains at the forefront of the industry.

The Property Appraisal Process

Steps in the Appraisal Process

The property appraisal process in Davenport County involves several key steps:

- Property Inspection: Appraisers conduct a thorough inspection of the property, noting its condition, size, and any unique features.

- Data Collection: Appraisers gather data on similar properties in the area to establish a benchmark for valuation.

- Valuation Analysis: Using various methods, appraisers calculate the property's market value based on its features and the local market conditions.

- Final Assessment: The appraiser submits a final report detailing the property's value and any factors that influenced the assessment.

This process ensures that property owners receive a fair and accurate appraisal, which is essential for tax purposes and property transactions.

Understanding Property Valuation Methods

Common Valuation Methods

Property appraisers in Davenport County use several methods to determine the value of a property:

- Market Approach: Compares the property to similar properties that have recently sold in the area.

- Cost Approach: Calculates the cost of replacing the property, minus depreciation.

- Income Approach: Estimates the property's value based on its potential income generation.

Each method has its strengths and is used depending on the type of property and the purpose of the appraisal. Understanding these methods can help property owners better grasp the factors influencing their property's value.

Impact of Property Appraisal on Taxes

Property Taxes and Appraisal

The assessed value of a property directly affects the amount of property taxes owed. In Davenport County, property taxes are calculated based on the appraised value of the property, with adjustments made for exemptions and deductions. Property owners should be aware of how property appraisal impacts their tax liabilities and take steps to ensure accurate assessments.

Exemptions and Deductions

Some property owners may qualify for exemptions or deductions that reduce their property tax burden. These include homestead exemptions, senior citizen discounts, and disability exemptions. The Davenport County Property Appraiser's office provides information on these options and assists property owners in applying for them.

Resolving Property Appraisal Disputes

The Appeals Process

If a property owner disagrees with their property appraisal, they can file an appeal with the Davenport County Property Appraiser's office. The appeals process involves submitting a formal request and providing evidence to support the owner's claim. The office reviews the appeal and may conduct a re-inspection of the property if necessary.

Resolving Disputes

Resolving appraisal disputes requires clear communication and collaboration between property owners and appraisers. The Davenport County Property Appraiser's office is committed to resolving disputes fairly and efficiently, ensuring that all property owners receive accurate and equitable assessments.

Tools and Resources for Property Appraisal

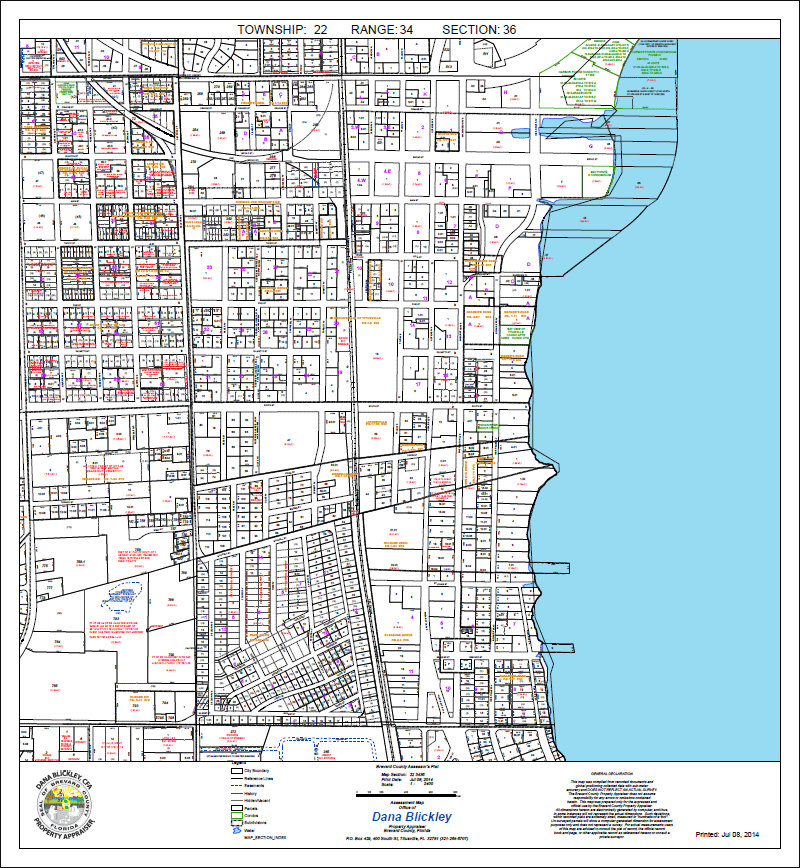

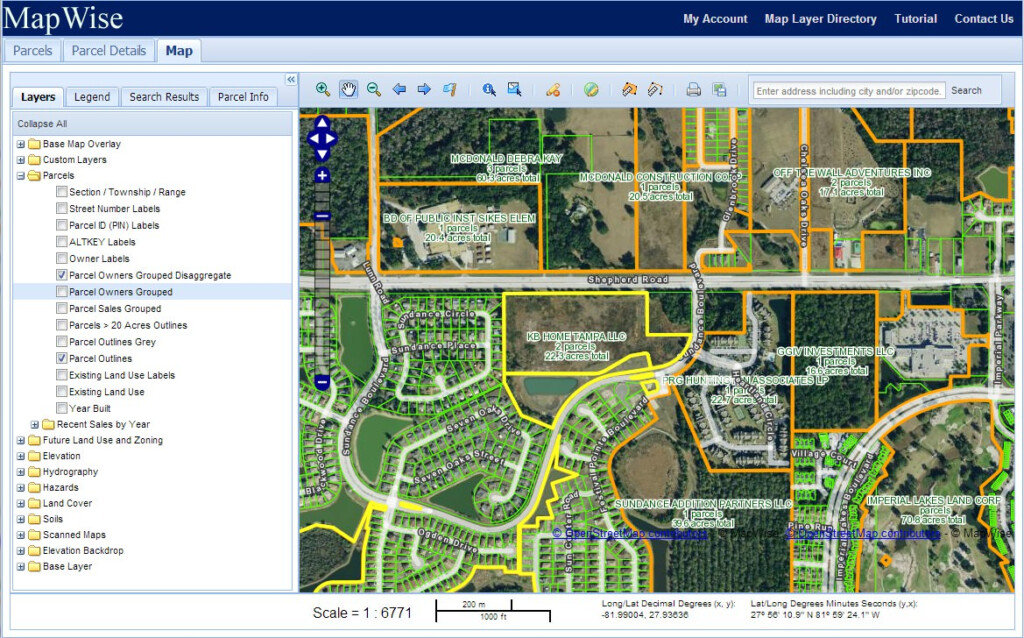

Technology in Property Appraisal

The Davenport County Property Appraiser's office utilizes advanced technology to improve the accuracy and efficiency of property appraisals. Tools such as Geographic Information Systems (GIS) and online property databases provide appraisers with up-to-date information on properties and market trends.

Resources for Property Owners

Property owners can access a variety of resources to learn more about the appraisal process and their property's value. The Davenport County Property Appraiser's website offers tools such as property search engines, tax calculators, and educational materials to help property owners make informed decisions.

Property Appraisal and Market Trends

Analyzing Market Trends

Property appraisal is closely tied to market trends, which can influence property values significantly. In Davenport County, appraisers monitor market conditions to ensure that property assessments reflect current market values. Understanding these trends can help property owners anticipate changes in their property's value and plan accordingly.

Legal Aspects of Property Appraisal

Property Appraisal Laws

Property appraisal in Davenport County is governed by state and federal laws that ensure fairness and consistency in the appraisal process. These laws outline the responsibilities of appraisers, the rights of property owners, and the procedures for resolving disputes. Property owners should familiarize themselves with these laws to protect their rights and interests.

Conclusion and Call to Action

In conclusion, the Davenport County Property Appraiser plays a crucial role in maintaining a fair and transparent real estate market. By understanding the appraisal process, valuation methods, and legal aspects, property owners can better manage their properties and make informed financial decisions. We encourage you to explore the resources provided by the Davenport County Property Appraiser's office and take advantage of the tools and information available to you.

We invite you to share your thoughts and experiences in the comments section below. If you found this guide helpful, please share it with others who may benefit from it. For more information on property appraisal and related topics, explore our other articles and resources.

Remember, accurate property appraisal is essential for maintaining a stable and equitable real estate market. Stay informed and proactive in managing your property's value and tax liabilities.

Data and statistics referenced in this article are sourced from reputable organizations such as the National Association of Realtors, the International Association of Assessing Officers, and local government reports. For further reading, consult these sources to deepen your understanding of property appraisal and its impact on the real estate market.