Filing an annual report with the Arizona Corporation Commission (ACC) is a crucial legal requirement for businesses operating in Arizona. This document ensures compliance with state regulations and helps maintain the good standing of your business. Understanding the process, deadlines, and necessary documentation can save you time and avoid penalties.

For businesses in Arizona, staying compliant with state regulations is not just a formality but a critical aspect of running a successful operation. One of the key obligations is submitting an annual report to the Arizona Corporation Commission. This report provides essential information about your business to the state, ensuring transparency and accountability.

In this article, we will delve into the details of how to file an annual report with the Arizona Corporation Commission. Whether you're a small business owner or part of a larger corporation, this guide will provide you with step-by-step instructions, important deadlines, and tips to ensure a smooth filing process.

Read also:Movierulz Ndash Your Ultimate Guide To Downloading Telugu Movies Legally

Understanding the Arizona Corporation Commission

The Arizona Corporation Commission (ACC) is a state agency responsible for regulating businesses and ensuring they comply with Arizona's laws. It plays a vital role in maintaining the integrity of the business environment by overseeing corporate filings, including annual reports. Understanding the ACC's role and responsibilities is essential for any business operating in Arizona.

Functions of the Arizona Corporation Commission

The ACC performs several important functions, including:

- Regulating public utilities

- Overseeing corporate filings and registrations

- Ensuring businesses maintain compliance with state laws

- Protecting consumers through fair business practices

By filing an annual report, businesses contribute to the ACC's mission of maintaining a transparent and accountable business environment.

Why File an Annual Report with the Arizona Corporation Commission?

Filing an annual report is not just a legal requirement; it also offers several benefits to businesses. This report allows the state to verify your business's continued existence and update any relevant information. It also helps maintain your business's good standing, which is crucial for accessing loans, entering contracts, and conducting business transactions.

Benefits of Filing an Annual Report

- Maintains your business's good standing

- Provides public access to accurate business information

- Helps prevent penalties or revocation of your business license

- Supports the state's efforts to regulate businesses effectively

Failure to file an annual report can result in fines, penalties, or even dissolution of your business. Therefore, it's essential to prioritize this task and ensure timely submission.

Who Must File an Annual Report?

Most businesses registered with the Arizona Corporation Commission are required to file an annual report. This includes corporations, limited liability companies (LLCs), partnerships, and other business entities. However, there are some exceptions, so it's important to verify your specific obligations based on your business structure.

Read also:Hd Hub 4u Your Ultimate Destination For Highquality Movies And Entertainment

Types of Businesses Required to File

Here are some common business types that must file an annual report:

- Corporations

- Limited Liability Companies (LLCs)

- Limited Partnerships (LPs)

- General Partnerships

Foreign businesses operating in Arizona must also file an annual report to comply with state regulations.

When Is the Annual Report Due?

The deadline for filing an annual report with the Arizona Corporation Commission depends on your business's incorporation date. Generally, the report is due on the anniversary of your business's formation or registration in Arizona. Missing this deadline can result in penalties, so it's crucial to keep track of your filing date.

Consequences of Late Filing

Failure to file your annual report on time can lead to:

- Financial penalties

- Suspension of your business's good standing

- Loss of legal protection for your business

- Potential dissolution of your business

To avoid these consequences, set reminders and ensure you submit your report before the deadline.

How to File an Annual Report Online

The Arizona Corporation Commission provides an easy and convenient online filing system for annual reports. This method is fast, secure, and allows you to pay any associated fees electronically. Here's a step-by-step guide to filing your annual report online:

Step-by-Step Guide

- Visit the Arizona Corporation Commission's official website.

- Log in to your account or create one if you haven't already.

- Select the "File an Annual Report" option.

- Enter the required information, including your business's name, address, and other details.

- Review your report for accuracy and completeness.

- Pay the filing fee using a credit card or electronic check.

- Submit your report and receive a confirmation.

By following these steps, you can ensure a smooth and hassle-free filing process.

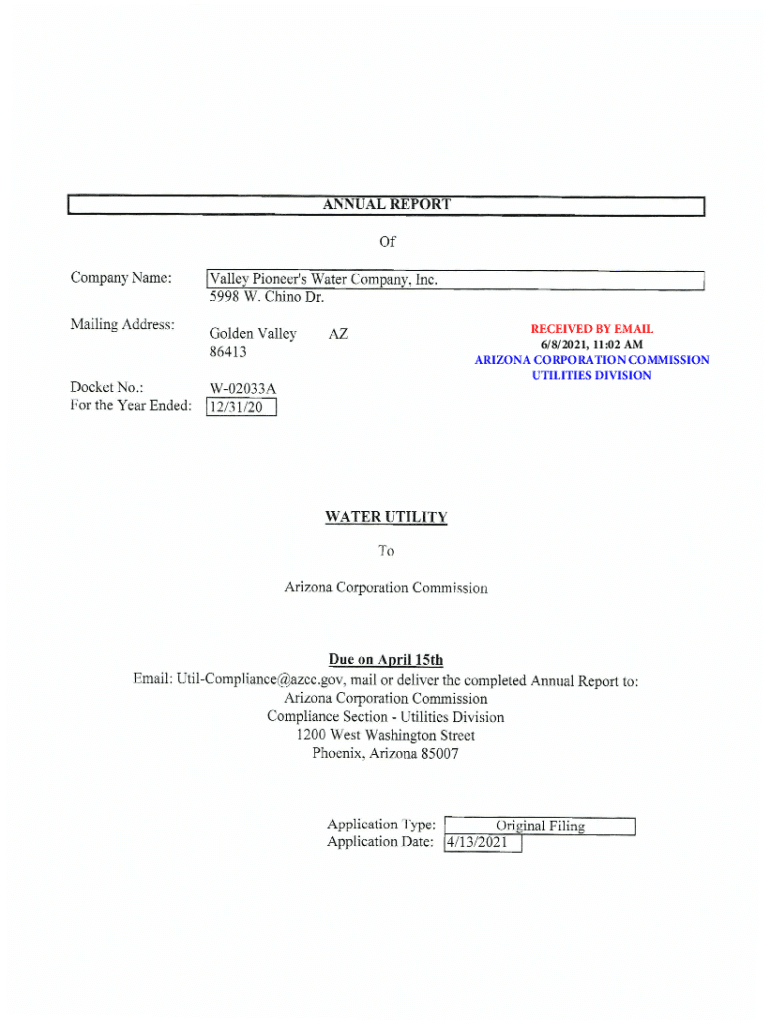

What Information Is Required in the Annual Report?

Your annual report must include specific information about your business to ensure compliance with Arizona's regulations. This information typically includes your business's name, address, registered agent, and other relevant details. Providing accurate and up-to-date information is crucial for maintaining your business's good standing.

Key Information to Include

Here are some of the key pieces of information you need to include in your annual report:

- Business name and address

- Registered agent's name and address

- List of directors or managers

- Financial information, if required

Double-check all information before submitting your report to avoid errors or delays.

How Much Does It Cost to File an Annual Report?

The cost of filing an annual report with the Arizona Corporation Commission varies depending on your business type and structure. Fees are generally moderate and are designed to cover the administrative costs associated with processing your report. Understanding these fees can help you budget accordingly.

Filing Fees by Business Type

Here are some common filing fees:

- Corporations: $50

- LLCs: $50

- Limited Partnerships: $50

These fees are subject to change, so always verify the current rates on the ACC's website.

Tips for a Successful Annual Report Filing

To ensure a smooth and successful filing process, consider the following tips:

- Start preparing your report well in advance of the deadline.

- Double-check all information for accuracy and completeness.

- Pay the filing fee promptly to avoid delays.

- Keep a copy of your submitted report for your records.

By following these tips, you can minimize the risk of errors and ensure timely submission of your annual report.

Common Mistakes to Avoid When Filing an Annual Report

While filing an annual report is a straightforward process, some common mistakes can lead to complications. Avoiding these errors can save you time and prevent unnecessary headaches.

Avoid These Common Mistakes

- Missing the filing deadline

- Providing incomplete or inaccurate information

- Forgetting to update changes in business information

- Not paying the filing fee on time

Stay vigilant and double-check all details to ensure a successful filing.

Resources and Support for Filing an Annual Report

If you encounter any issues or have questions about filing your annual report, several resources are available to assist you. The Arizona Corporation Commission offers a help desk, FAQs, and other support materials to guide you through the process.

Useful Resources

- ACC Help Desk: Contact them for personalized assistance.

- FAQs: Find answers to common questions on their website.

- Guides and Tutorials: Access step-by-step guides to help you file your report.

Utilizing these resources can make the filing process easier and more efficient.

Conclusion

Filing an annual report with the Arizona Corporation Commission is a critical obligation for businesses operating in Arizona. By understanding the process, deadlines, and required information, you can ensure compliance and maintain your business's good standing. Remember to file your report on time, avoid common mistakes, and utilize available resources for support.

We encourage you to take action by starting your annual report preparation early and submitting it before the deadline. Don't hesitate to reach out to the Arizona Corporation Commission for assistance if needed. Additionally, feel free to share this article with fellow business owners or leave a comment below if you have any questions or feedback. Together, we can ensure a compliant and thriving business environment in Arizona.

Table of Contents

- Understanding the Arizona Corporation Commission

- Why File an Annual Report with the Arizona Corporation Commission?

- Who Must File an Annual Report?

- When Is the Annual Report Due?

- How to File an Annual Report Online

- What Information Is Required in the Annual Report?

- How Much Does It Cost to File an Annual Report?

- Tips for a Successful Annual Report Filing

- Common Mistakes to Avoid When Filing an Annual Report

- Resources and Support for Filing an Annual Report