In today's fast-paced financial world, finding value stocks that can truly enhance your investment portfolio is a challenge many investors face. 5starsstocks.com has emerged as a trusted platform for investors seeking to identify undervalued stocks with high growth potential. By focusing on value stocks, this platform helps investors make informed decisions and maximize returns on their investments.

The concept of value investing has been around for decades, popularized by legendary investors like Warren Buffett and Benjamin Graham. It revolves around identifying companies whose stock prices are lower than their intrinsic value. By using 5starsstocks.com, investors can tap into a wealth of resources designed to help them uncover these hidden gems in the stock market.

As the financial landscape evolves, having access to reliable data and expert analysis is crucial. This article will delve into the world of value stocks, exploring how 5starsstocks.com can assist investors in building a robust portfolio. We'll also cover essential strategies and tips to help you make the most of this platform.

Read also:5movierulz 310831423122313730953137 2023 Your Ultimate Guide To Telugu Movies

Understanding Value Stocks

What Are Value Stocks?

Value stocks represent companies whose current market price is lower than their intrinsic value. These stocks are often undervalued due to temporary setbacks, market sentiment, or lack of investor awareness. However, they hold significant potential for growth and appreciation over time.

- Value stocks are typically identified by metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield.

- Investors who practice value investing focus on fundamental analysis to evaluate the true worth of a company.

- By purchasing value stocks, investors can benefit from long-term capital appreciation as the market recognizes the company's true potential.

Why Invest in Value Stocks?

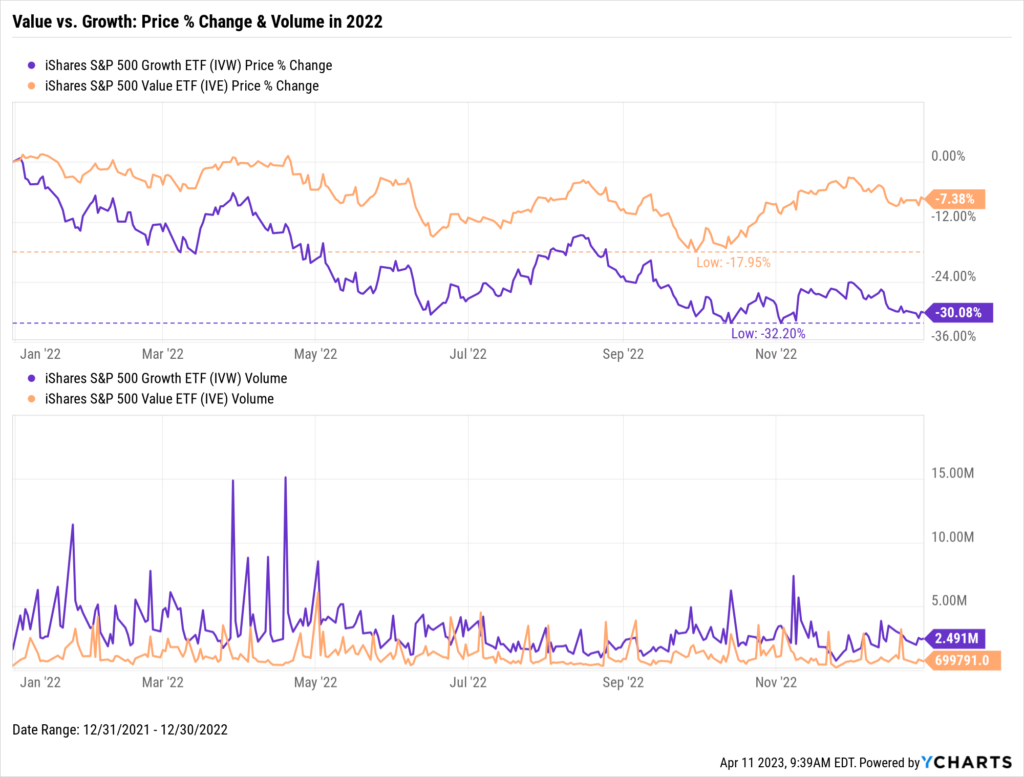

Value stocks offer several advantages over other investment options. They tend to provide higher returns compared to growth stocks, especially during market downturns. Additionally, they often come with attractive dividend yields, making them an ideal choice for income-focused investors.

According to a study by Fama and French, value stocks have historically outperformed the broader market over the long term. This underscores the importance of incorporating value stocks into your investment portfolio.

5starsstocks.com: A Comprehensive Platform for Value Investors

Overview of 5starsstocks.com

5starsstocks.com is a leading platform dedicated to helping investors identify and analyze value stocks. The website provides a wealth of resources, including stock screeners, research tools, and expert analysis, all designed to assist investors in making informed decisions.

One of the standout features of 5starsstocks.com is its user-friendly interface, which makes it accessible to both novice and experienced investors. The platform also offers customizable alerts, allowing users to stay updated on the latest market trends and stock performance.

Key Features of 5starsstocks.com

- Advanced Stock Screeners: Identify undervalued stocks based on customizable criteria such as P/E ratio, dividend yield, and earnings growth.

- Expert Analysis: Access in-depth reports and analyses from industry professionals, providing valuable insights into market trends and stock performance.

- Customizable Alerts: Stay informed with real-time notifications about stock price movements, earnings reports, and other critical events.

Strategies for Identifying Value Stocks

Using Fundamental Analysis

Fundamental analysis is a cornerstone of value investing. It involves evaluating a company's financial health, management quality, and competitive position in the market. By analyzing key metrics such as earnings per share (EPS), revenue growth, and return on equity (ROE), investors can determine whether a stock is undervalued.

Read also:Hdhub4u New Movie Releases 2025 Your Ultimate Guide To Latest Blockbusters

For example, a company with a low P/E ratio but strong earnings growth potential may represent an attractive value stock. Similarly, a high dividend yield combined with a stable payout ratio can indicate a solid investment opportunity.

Quantitative Screening Techniques

Quantitative screening involves using mathematical models to identify stocks that meet specific criteria. This approach is particularly useful for investors who prefer a data-driven methodology. By leveraging tools like 5starsstocks.com's stock screener, investors can quickly identify value stocks based on predefined parameters.

Some popular quantitative screening techniques include:

- PEG Ratio Analysis: Combines P/E ratio with earnings growth to identify undervalued stocks with strong growth potential.

- Enterprise Value-to-EBITDA (EV/EBITDA): Measures a company's valuation relative to its earnings before interest, taxes, depreciation, and amortization.

Building a Diversified Value Stock Portfolio

Importance of Diversification

Diversification is a critical component of any investment strategy. By spreading investments across different sectors and asset classes, investors can reduce risk and enhance returns. When building a value stock portfolio, it's essential to consider factors such as industry exposure, geographic location, and company size.

For instance, an investor might allocate a portion of their portfolio to value stocks in the technology sector, while also including stocks from industries such as healthcare and consumer goods. This approach helps mitigate the impact of sector-specific risks and ensures a balanced portfolio.

Selecting the Right Mix of Value Stocks

Selecting the right mix of value stocks requires careful consideration of various factors. Investors should focus on companies with strong fundamentals, sustainable competitive advantages, and attractive valuations. Additionally, it's important to consider the macroeconomic environment and its potential impact on stock performance.

5starsstocks.com provides valuable resources to help investors make informed decisions. By utilizing the platform's research tools and expert analysis, investors can identify value stocks that align with their investment objectives and risk tolerance.

Case Studies of Successful Value Investments

Warren Buffett's Berkshire Hathaway

Warren Buffett, often referred to as the "Oracle of Omaha," is a renowned value investor who has achieved remarkable success through disciplined investment strategies. His flagship company, Berkshire Hathaway, has consistently outperformed the market by focusing on undervalued stocks with strong fundamentals.

One notable example is Buffett's investment in Coca-Cola. By purchasing shares at a time when the company was undervalued, Buffett was able to capitalize on its long-term growth potential. This investment has since become one of Berkshire Hathaway's most successful holdings.

Benjamin Graham's Value Investing Principles

Benjamin Graham, often regarded as the father of value investing, developed several key principles that continue to guide investors today. These include:

- Marginal Safety: Ensuring a margin of safety by purchasing stocks at a discount to their intrinsic value.

- Focus on Fundamentals: Evaluating a company's financial health and competitive position before making an investment decision.

- Long-Term Perspective: Maintaining a long-term outlook and avoiding short-term market fluctuations.

Challenges and Risks in Value Investing

Market Volatility

Value investing is not without its challenges. Market volatility can pose a significant risk, as stock prices may fluctuate due to external factors such as economic uncertainty or geopolitical tensions. However, by maintaining a disciplined approach and focusing on long-term fundamentals, investors can navigate these challenges successfully.

Identifying Truly Undervalued Stocks

One of the primary challenges in value investing is distinguishing between truly undervalued stocks and those that are fundamentally weak. This requires a thorough understanding of financial statements, industry dynamics, and market trends. Tools like 5starsstocks.com can help investors overcome this challenge by providing access to reliable data and expert analysis.

Tips for Maximizing Returns with Value Stocks

Stay Informed

Staying informed about market trends and economic developments is crucial for value investors. By regularly monitoring news sources, financial reports, and expert opinions, investors can make timely and informed decisions.

Utilize Technology and Tools

Technology and tools like 5starsstocks.com can significantly enhance the value investing process. By leveraging advanced stock screeners, research tools, and customizable alerts, investors can quickly identify undervalued stocks and stay ahead of market trends.

Conclusion

In conclusion, value investing remains a powerful strategy for building wealth over the long term. Platforms like 5starsstocks.com provide investors with the resources and tools needed to identify undervalued stocks and make informed investment decisions. By focusing on fundamental analysis, diversification, and disciplined strategies, investors can unlock the hidden gems in the stock market and achieve their financial goals.

We invite you to explore the wealth of resources available on 5starsstocks.com and take the first step towards building a robust value stock portfolio. Share your thoughts and experiences in the comments below, and don't forget to check out our other articles for more insights into the world of investing.

Table of Contents

- Understanding Value Stocks

- 5starsstocks.com: A Comprehensive Platform for Value Investors

- Strategies for Identifying Value Stocks

- Building a Diversified Value Stock Portfolio

- Case Studies of Successful Value Investments

- Challenges and Risks in Value Investing

- Tips for Maximizing Returns with Value Stocks

- Conclusion