Are you eagerly waiting for your Minnesota tax refund? Many taxpayers in Minnesota find themselves asking, "Where is my Minnesota tax refund?" The process of filing taxes can be complex, and understanding the status of your refund is crucial for financial planning. In this article, we will delve into everything you need to know about tracking and understanding your Minnesota tax refund.

Minnesota residents often rely on their tax refunds to meet financial obligations or make significant purchases. However, the refund process can sometimes be confusing, leading to frustration if not properly understood. This guide aims to simplify the process and provide actionable steps to help you track your refund efficiently.

By the end of this article, you will have a clear understanding of how the Minnesota tax refund system works, common reasons for delays, and practical tips to ensure a smooth refund process. Let’s dive in!

Read also:Firebirds In North Hills Exploring The Fascinating World Of Firebirds And Their Unique Habitat

Table of Contents

- Understanding the Minnesota Tax Refund Process

- How to Track Your Minnesota Tax Refund

- Common Reasons for Minnesota Tax Refund Delays

- Avoiding Filing Mistakes That Delay Refunds

- How IRS Rules Affect Minnesota Tax Refunds

- Minnesota State Laws and Tax Refunds

- Checking Your Minnesota Tax Refund Status

- Benefits of Direct Deposit for Minnesota Tax Refunds

- Understanding Tax Credits and Their Impact on Refunds

- Conclusion and Next Steps

Understanding the Minnesota Tax Refund Process

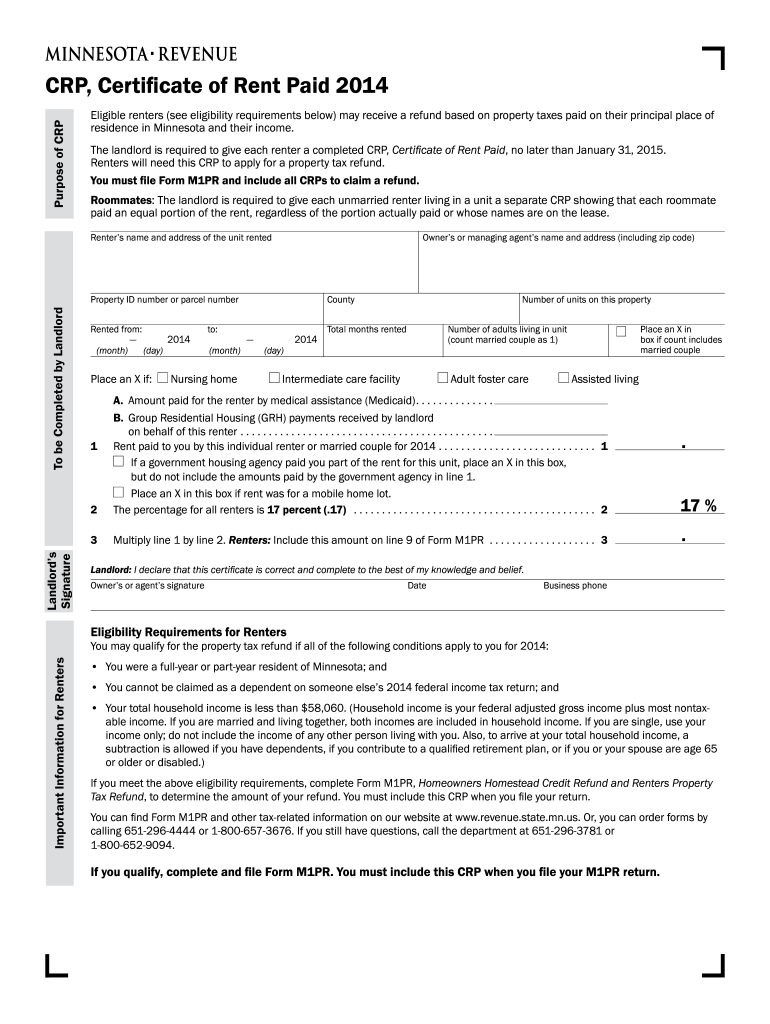

When you file your Minnesota state tax return, the Minnesota Department of Revenue (MDR) evaluates your submission to determine whether you are entitled to a refund. The refund process typically involves several stages, including verification of your tax return, calculation of the refund amount, and processing the payment.

Stages of the Refund Process

- Verification: The MDR checks your tax return for accuracy and compliance with state laws.

- Calculation: Once verified, the department calculates the exact amount of your refund based on your tax liabilities and payments made.

- Processing: After the calculation, the refund is processed and sent to you via your preferred method, whether it’s direct deposit or a physical check.

This process can take anywhere from a few weeks to several months, depending on various factors such as the complexity of your return and any additional documentation required.

How to Track Your Minnesota Tax Refund

One of the most common questions taxpayers ask is, "Where is my Minnesota tax refund?" Fortunately, there are several ways to track the status of your refund:

Online Tracking Tools

The Minnesota Department of Revenue provides an online tool where you can check the status of your refund. Simply visit their official website and enter your Social Security Number (SSN) and the exact refund amount shown on your tax return.

Phone Assistance

If you prefer speaking to a representative, you can call the MDR’s customer service line. They can provide updates on your refund status and address any concerns you may have.

Common Reasons for Minnesota Tax Refund Delays

While the refund process is generally efficient, there are instances where delays may occur. Below are some common reasons for Minnesota tax refund delays:

Read also:The Andiron Seaside Inn Your Ultimate Coastal Retreat

- Errors in Filing: Mistakes in your tax return, such as incorrect SSN or bank account information, can cause delays.

- Identity Theft: If your identity has been compromised, the MDR may need additional time to verify your information.

- Complex Returns: Returns involving complex deductions or credits may require more time to process.

Understanding these potential delays can help you prepare and avoid unnecessary stress.

Avoiding Filing Mistakes That Delay Refunds

To ensure a smooth refund process, it’s essential to avoid common filing mistakes. Here are some tips:

Double-Check Your Information

- Ensure all personal and financial information is accurate.

- Verify your bank account details if you opt for direct deposit.

File Early

Filing your tax return early can help you receive your refund sooner, as it reduces the workload on the MDR during peak seasons.

How IRS Rules Affect Minnesota Tax Refunds

While Minnesota tax refunds are managed by the MDR, federal rules set by the IRS can also impact your refund. For example, if you owe federal taxes, the IRS may offset your state refund to cover the debt.

Key IRS Regulations

- Offset Program: The Treasury Offset Program allows federal agencies to offset state refunds for unpaid debts.

- Compliance Checks: The IRS may conduct additional checks if discrepancies are found between federal and state returns.

Minnesota State Laws and Tax Refunds

Minnesota has specific laws governing tax refunds. Understanding these laws can help you navigate the refund process more effectively:

Refund Deadlines

Minnesota law requires the MDR to issue refunds within a certain timeframe. However, this timeframe can be extended if additional documentation is needed.

Refund Interest

In some cases, Minnesota taxpayers may be entitled to interest on delayed refunds. This interest is calculated based on the number of days the refund is delayed beyond the standard processing period.

Checking Your Minnesota Tax Refund Status

Checking your refund status is simple and can be done through various channels. Here’s a step-by-step guide:

Using the MDR Website

- Visit the Minnesota Department of Revenue website.

- Locate the "Where’s My Refund?" tool.

- Enter your SSN and refund amount.

Calling the MDR

For personalized assistance, call the MDR’s customer service line and follow the prompts to speak with a representative.

Benefits of Direct Deposit for Minnesota Tax Refunds

Opting for direct deposit is one of the best ways to expedite your Minnesota tax refund. Here are some benefits:

- Faster Processing: Direct deposits are typically processed faster than physical checks.

- Convenience: You don’t have to wait for the mail or visit the bank to deposit your check.

- Security: Direct deposit reduces the risk of lost or stolen checks.

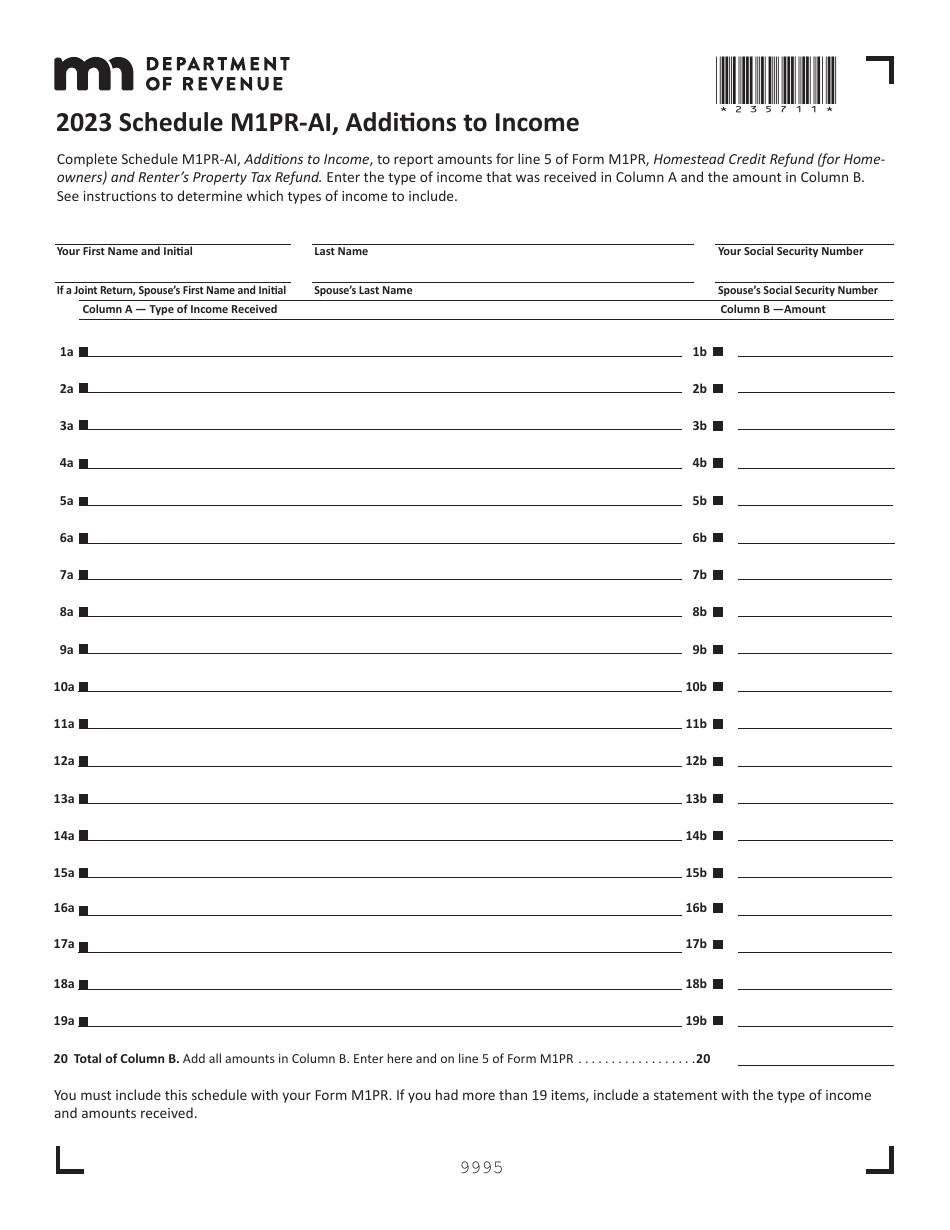

Understanding Tax Credits and Their Impact on Refunds

Tax credits can significantly impact the amount of your Minnesota tax refund. Some common credits include the Homestead Credit and the Working Family Credit.

Homestead Credit

This credit is available to Minnesota residents who own and occupy their homes. It reduces property taxes and can increase your refund amount.

Working Family Credit

Designed to assist low- and middle-income families, this credit can provide substantial refunds for eligible taxpayers.

Conclusion and Next Steps

In conclusion, understanding the Minnesota tax refund process is essential for ensuring timely receipt of your refund. By following the tips and guidelines outlined in this article, you can minimize delays and maximize your refund.

We encourage you to take action by checking your refund status regularly and utilizing direct deposit for faster processing. If you have any questions or need further assistance, feel free to leave a comment or explore other resources on our website.

Remember, staying informed is the key to a successful tax refund experience. Share this article with friends and family to help them navigate their Minnesota tax refunds with ease.

References:

- Minnesota Department of Revenue

- Internal Revenue Service

- Treasury Offset Program