TPG products on bank statements have become increasingly common as financial institutions partner with telecommunications companies to offer integrated services. Understanding what these products represent and how they appear on your bank statements is essential for maintaining financial transparency and ensuring accurate budgeting. In this article, we'll explore everything you need to know about TPG products, their relevance on bank statements, and how to manage them effectively.

Whether you're a long-time customer of TPG or a newcomer, it's crucial to understand how your telecommunications services are reflected in your financial records. This knowledge empowers you to make informed decisions about your spending and avoid unnecessary charges. In today's digital age, where financial literacy is paramount, staying informed about your bank statements is more important than ever.

Our guide will cover everything from the basics of TPG products to advanced tips for managing your finances. By the end of this article, you'll have a clear understanding of how these products impact your bank statements and how you can optimize your financial planning accordingly. Let's dive in!

Read also:Sonic Small Shake Price A Comprehensive Guide To Enjoy Your Favorite Treat

Table of Contents

- What Are TPG Products?

- TPG Products on Bank Statements

- Understanding TPG Statements

- Common TPG Products

- Managing TPG Products

- How to Read Bank Statements

- Avoiding Unnecessary Charges

- TPG Customer Support

- Frequently Asked Questions

- Conclusion

What Are TPG Products?

TPG, or Trans Pacific Group, is a leading telecommunications provider offering a wide range of services, including mobile plans, internet services, and home phone packages. These products are designed to cater to various customer needs, from budget-friendly options to premium plans with advanced features.

TPG products are often integrated into bank statements as part of automated billing processes. This integration allows customers to conveniently manage their telecommunications expenses alongside other financial transactions.

Some of the key features of TPG products include:

- Competitive pricing for mobile and internet services

- Flexible plans tailored to individual and business needs

- Reliable customer support and technical assistance

TPG Products on Bank Statements

When you subscribe to TPG services, the charges for these products will appear on your bank statements. Understanding how these charges are listed is essential for maintaining financial clarity. Typically, TPG products on bank statements are labeled clearly, making it easy for customers to identify them.

For example, you might see entries such as "TPG Mobile Charge" or "TPG Internet Subscription" on your bank statement. These labels help you track your expenses and ensure that all charges are legitimate.

To better manage your TPG products on bank statements, consider the following tips:

Read also:Minecraft Ocean Monument Lego A Comprehensive Guide To Building And Exploring

- Regularly review your statements for any discrepancies

- Set up automatic alerts for unusual transactions

- Keep records of your TPG invoices for reference

Identifying TPG Charges

Identifying TPG charges on your bank statement is straightforward. Most financial institutions use standardized labels for recurring payments, making it easier to spot TPG-related entries. Additionally, TPG provides detailed invoices that can be cross-referenced with your bank statements for accuracy.

Understanding TPG Statements

TPG statements provide a comprehensive overview of your telecommunications usage and associated charges. These statements are an essential tool for monitoring your expenses and ensuring that you're getting the most value from your TPG products.

Key components of a TPG statement include:

- Monthly subscription fees

- Data usage and overage charges

- Additional services, such as SMS or international calls

By understanding your TPG statement, you can make informed decisions about your service plan and avoid unexpected charges.

Comparing TPG Statements with Bank Statements

Comparing your TPG statement with your bank statement is a good practice for maintaining financial accuracy. This process involves matching the charges listed in your TPG invoice with the corresponding entries on your bank statement.

Common TPG Products

TPG offers a variety of products to meet the diverse needs of its customers. Some of the most popular TPG products include:

- Mobile Plans: Flexible and affordable options for personal and business use

- Internet Services: High-speed broadband and NBN plans for home and office

- Home Phone Packages: Reliable landline services with competitive pricing

Each product is designed to provide value and convenience, making it easier for customers to stay connected without breaking the bank.

Benefits of TPG Products

The benefits of TPG products extend beyond cost savings. Customers enjoy:

- Reliable service with minimal downtime

- Customer-focused support and assistance

- Innovative features and technology integration

Managing TPG Products

Effectively managing your TPG products requires a proactive approach to monitoring and optimizing your usage. Start by reviewing your current plan to ensure it aligns with your needs. If you find that you're consistently exceeding your data limits or underutilizing your plan, consider upgrading or downgrading to a more suitable option.

Additionally, take advantage of TPG's self-service portal to manage your account online. This portal allows you to view your usage, update your billing information, and make payments conveniently.

Optimizing Your TPG Plan

Optimizing your TPG plan involves regularly assessing your usage patterns and adjusting your services accordingly. For instance, if you notice that you're not utilizing your allocated data, you might consider switching to a lower-tier plan to save money.

How to Read Bank Statements

Reading bank statements effectively is crucial for maintaining financial health. When reviewing your statements, pay attention to the following:

- Recurring charges, such as TPG products

- One-time transactions that may require further investigation

- Interest rates and fees associated with your accounts

By understanding how to read your bank statements, you can better manage your finances and avoid unnecessary expenses.

Tips for Reading Bank Statements

Here are some tips for reading bank statements more effectively:

- Set aside dedicated time each month to review your statements

- Use digital tools to organize and track your transactions

- Reach out to your bank if you notice any discrepancies

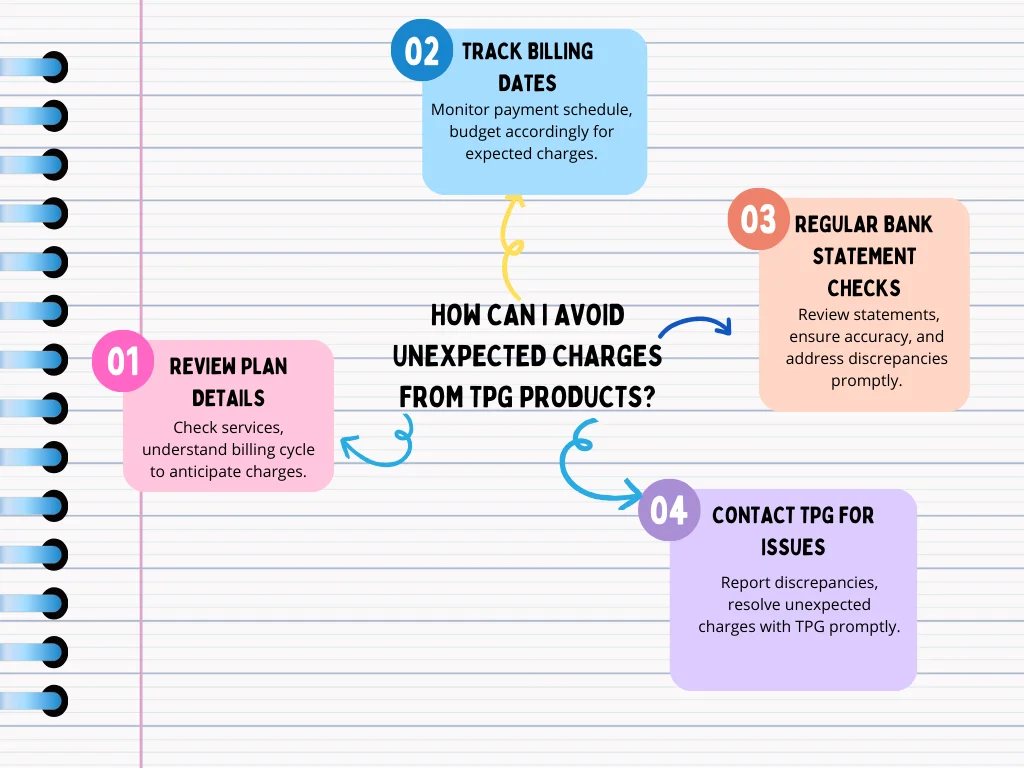

Avoiding Unnecessary Charges

Avoiding unnecessary charges is a key aspect of financial management. When it comes to TPG products on bank statements, there are several strategies you can employ to minimize unexpected expenses:

- Monitor your usage regularly to stay within your plan limits

- Set up alerts for approaching data caps or subscription renewals

- Review your billing statements monthly to catch any errors

By staying vigilant and proactive, you can ensure that your TPG products remain a cost-effective part of your financial plan.

Common Causes of Unnecessary Charges

Some common causes of unnecessary charges include:

- Exceeding data allowances

- Forgetting to cancel unused services

- Not reviewing billing statements regularly

TPG Customer Support

TPG offers robust customer support to assist with any issues related to your products and services. Whether you need help understanding your bill or want to upgrade your plan, TPG's support team is available to provide guidance and assistance.

Contacting TPG customer support is simple. You can reach them via phone, email, or through the TPG website's live chat feature. Additionally, TPG's online help center provides a wealth of resources, including FAQs and troubleshooting guides.

Getting the Most from TPG Support

To get the most from TPG customer support, follow these tips:

- Prepare any relevant documentation, such as invoices or account numbers

- Clearly describe your issue and desired outcome

- Follow up on any promises or commitments made during your interaction

Frequently Asked Questions

Q: Why do TPG products appear on my bank statement?

A: TPG products appear on your bank statement as part of the automated billing process. These entries represent charges for your telecommunications services, such as mobile plans or internet subscriptions.

Q: How can I dispute a charge on my bank statement?

A: To dispute a charge, contact your bank and provide any supporting documentation, such as your TPG invoice. Your bank will investigate the issue and resolve it accordingly.

Q: Can I change my TPG plan at any time?

A: Yes, you can change your TPG plan at any time by contacting TPG customer support or managing your account through the TPG self-service portal.

Conclusion

In conclusion, understanding TPG products on bank statements is essential for maintaining financial transparency and optimizing your telecommunications expenses. By staying informed about your TPG services and regularly reviewing your bank statements, you can ensure that your finances remain on track.

We encourage you to take action by reviewing your current TPG plan and exploring any opportunities for improvement. Don't forget to share this article with others who might benefit from the information, and feel free to leave a comment below with any questions or feedback.